The Rising Tide

A notable trend in the ASC industry is the increasing preference for outpatient settings for total joint and cardiovascular cases. This shift is more than just a change in location; it represents a paradigm shift in patient care and cost efficiency. Orthopedic and cardiovascular procedures, traditionally the domain of hospitals, are now moving into the more agile and cost-effective realm of ASCs. This trend aligns perfectly with the specialties that typically yield the highest profits: orthopedics and cardiovascular.

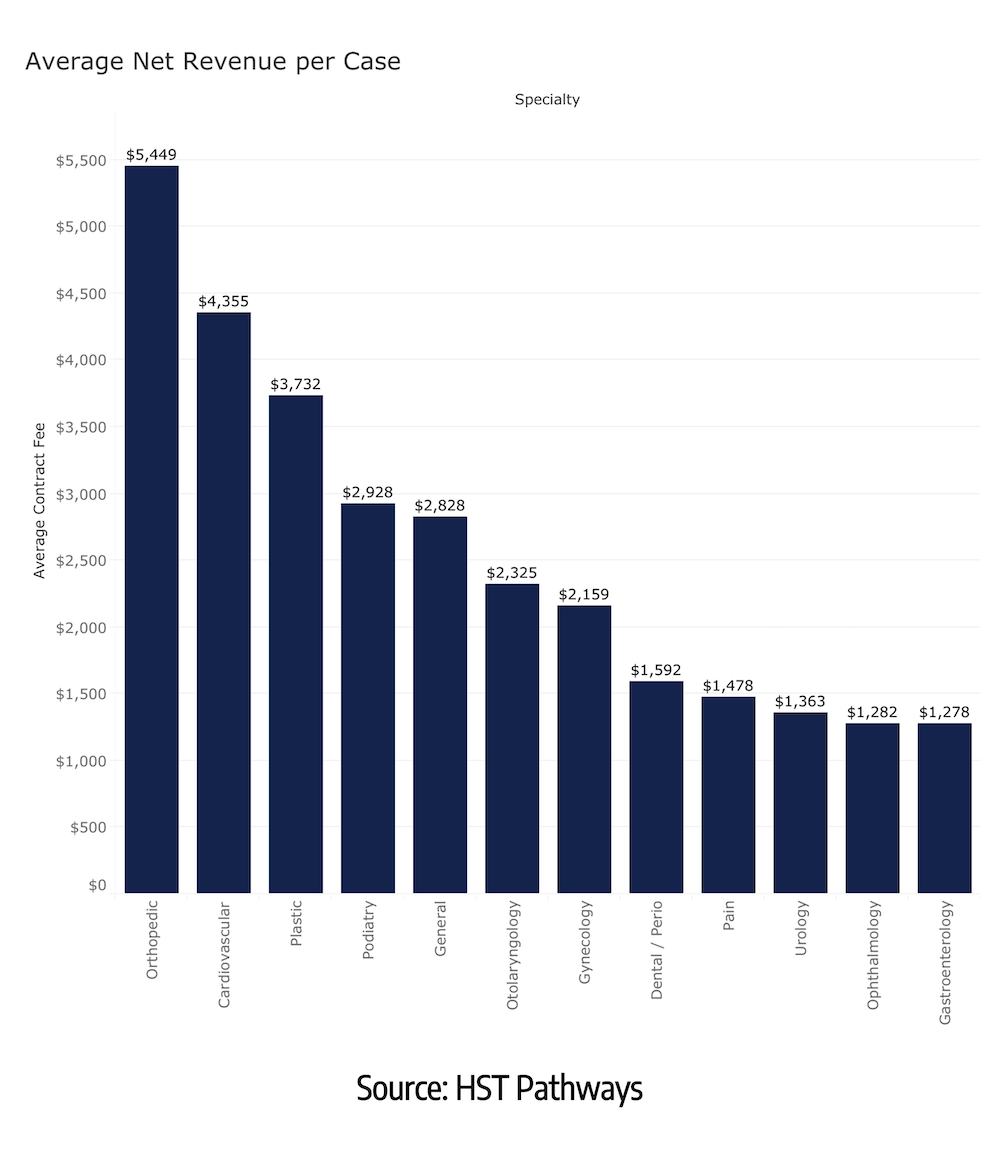

Highest Profit Margins Per Case

Based on the findings from our State of the Industry Report, released in September 2023, orthopedic cases (which includes total joints) bring in the highest average net revenue per case, averaging $5,449 per procedure. Cardiovascular brings in the second-highest average net revenue per case, averaging $4,335 per procedure.

As costs continue to rise and profit margins decrease, leaning into specialties with the highest revenue could be key to the longevity of your surgery center.

New Additions to the CMS 2024 Final Payment Rule

The 2024 CMS final payment rule has added total shoulder and total ankle procedures to the ASC-Covered Procedures List.

- 23470 (Reconstruct shoulder joint)

- 23472 (Reconstruct shoulder joint)

- 27702 (Reconstruct ankle joint)

This is a game-changer. It not only broadens the scope of services that ASCs can offer but also opens up new revenue streams. With these procedures now covered, ASCs can attract a larger patient base seeking these specific treatments.

Growing Payor & Consumer Demand

Payors prefer surgeries to be performed at ASCs over hospitals due to the significant cost savings, efficient resource utilization, lower infection rates, and overall high-quality patient care that ASCs can provide.

Patients, who are consumers at their core, are catching on to the benefits of having their procedures done at a surgery center versus a hospital, as well. They are beginning to understand that ASCs offer surgeries at a lower cost with better efficiency, specialized care, reduced risk of infection, and faster recovery times, all in a lower-stress environment.

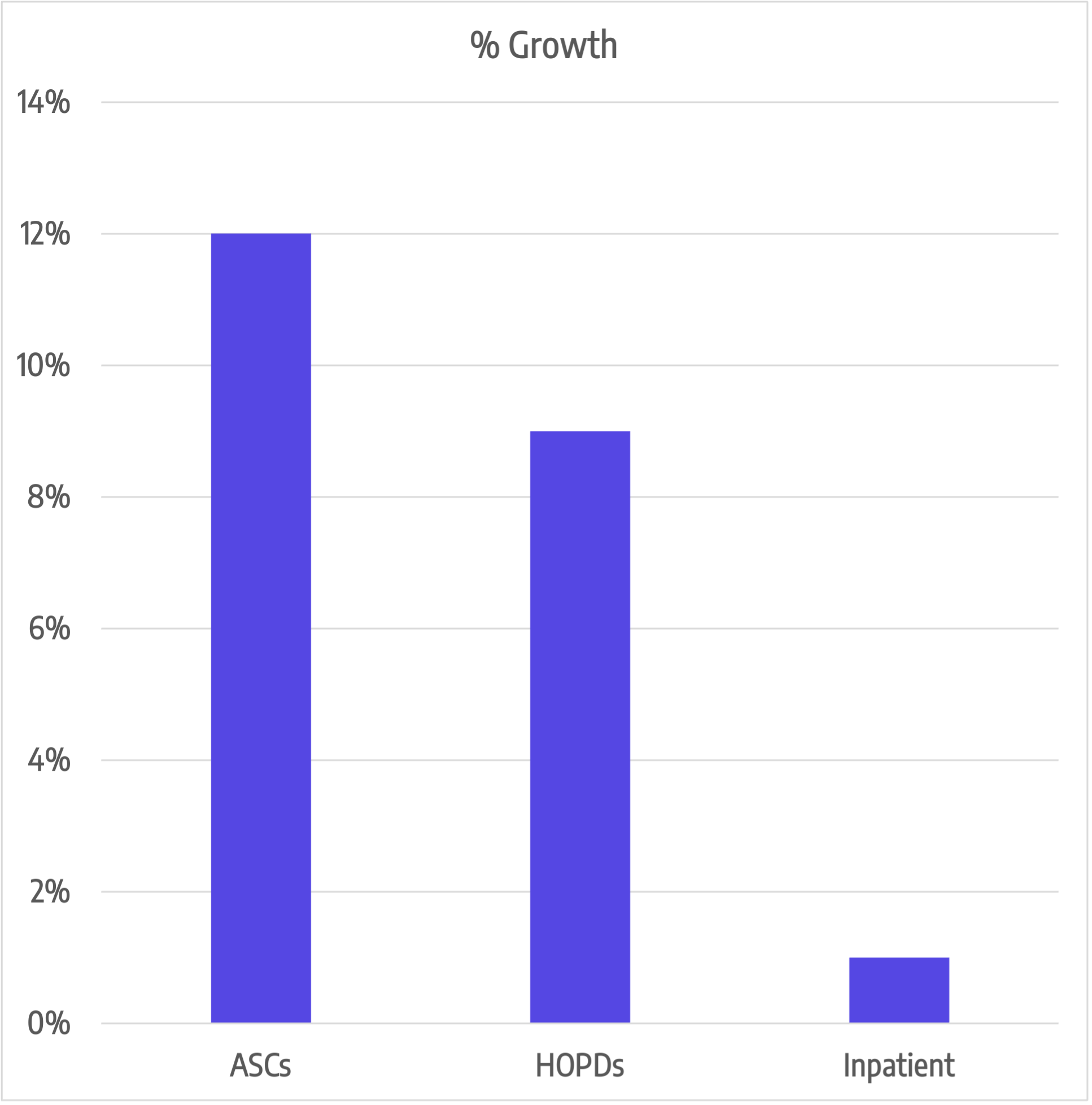

Sg2, a Vizient Company, published a report in June 2023, forecasting that:

- ASCs will see 12% growth in the next 5 years

- HOPDs will see 9% growth in the next 5 years

- Inpatient Surgeries will see a 1% growth in the next 5 years

Strategic Action for ASC Leaders

Physician Recruitment: Whether you are looking to expand the number of cases you perform or add these specialties into your mix for the first time, you will need the right physicians on your team. You can:

- Ask your current physicians to recruit their peers

- Use recruitment agencies or career boards

- Lean into local marketing efforts such as digital ads or billboards

Community Connection: Educate your community about the benefits of undergoing these procedures at an ASC. Focus on the advantages like reduced costs, shorter recovery times, and personalized care.

Invest in Specialized Equipment and Training: Ensuring that your facility is equipped with the necessary technology and that your staff is adequately trained in these specialties will be crucial. Although initially, this may involve significant capital expenditure on equipment, it is highly likely you will see a turn on investment (ROI) over a period of years.

The Time to Act is Now

With these developments, ASCs are in a prime position to capitalize on these high-profit specialties. By focusing on total joints and cardiovascular care, ASCs can not only enhance their growth but also play a pivotal role in reshaping the healthcare landscape. Seize this moment to redefine your growth strategy and position your ASC at the forefront of this exciting evolution in healthcare.

Don’t miss out on the good stuff – Subscribe to HST’s Blog & Podcast!

Every month we’ll email you our newest podcast episodes and articles. No fluff – just helpful content delivered right to your inbox.