When evaluating which specialties to prioritize in your ASC, revenue potential is a key factor to consider. Some specialties bring in steady margins through sheer volume, while others offer higher per-case returns but may require more investment to scale. Recent HST Pathways data highlights how emerging and longstanding specialties compare when it comes to revenue per case and overall contribution to the bottom line. Whether you’re planning your next service line expansion or fine-tuning your case mix, understanding these trends can help guide smart business decisions.

Who Informed These Insights

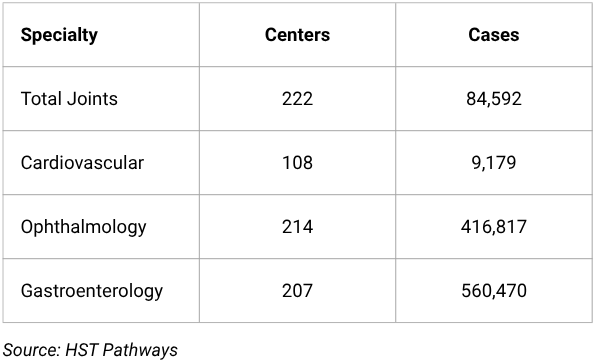

The insights shared in this column are based on HST Pathways’ aggregated client data from January 1, 2023, through December 31, 2024. We included data only from clients who provided permission and excluded extreme outliers.

Revenue Opportunity

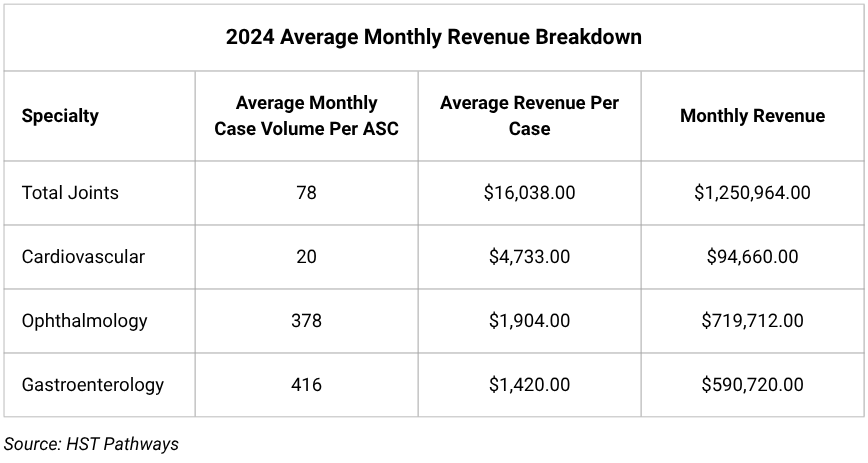

From a revenue-per-case perspective, the longstanding specialties continue to deliver steady growth but at significantly lower margins compared to their emerging counterparts. Ophthalmology saw an 8 percent increase in net revenue per case, rising from $1,770 to $1,904. Gastroenterology followed with a 6 percent bump, reaching $1,420 per case. These gains are consistent and reliable, making them valuable for maintaining overall financial stability, especially when paired with high case volume.

Among the emerging specialties, total joints are the clear standout. With a 7.5 percent increase year over year, average revenue per case climbed from $14,919 to $16,038—the highest of any specialty by far. This premium yield helps offset its comparatively lower case volume.

Cardiovascular revenue dipped slightly (2 percent) from $4,849 to $4,733 per case, but it still holds the second-highest per-case value overall. Despite the minor decline, cardiovascular remains a specialty worth exploring.

In short, longstanding specialties bring consistent, lower-margin returns at scale, while emerging specialties offer high-yield potential for growth-minded ASCs.

As the data shows, longstanding specialties like ophthalmology and gastroenterology continue to deliver dependable revenue through high-volume, lower-margin cases—providing a stable financial foundation for many ASCs. Meanwhile, emerging specialties like total joints and cardiovascular procedures offer exciting opportunities for higher per-case returns—but they come with added complexity and lower current volume. For growth-minded ASC leaders, the key is finding the right balance: leveraging the reliability of established specialties while thoughtfully investing in emerging ones that align with their market, capabilities, and long-term strategy.

Don’t miss out on the good stuff – Subscribe to HST’s Blog & Podcast!

Every month we’ll email you our newest podcast episodes and articles. No fluff – just helpful content delivered right to your inbox.